India’s love affair with convenience is reaching new heights, with a Deloitte report predicting the quick commerce market to reach a whopping $40 billion by 2030! This lightning-fast delivery segment is revolutionizing how Indians get their groceries. Let’s dive into the key players shaping this exciting space in 2024:

- Zomato’s Blinkit Blitz: The rapid growth of quick commerce has Zomato pushing even harder on Blinkit, its speedy grocery delivery service. They’re aiming to nearly double their dark store network by the end of the fiscal year 2025, solidifying their position in the race.

- JioMart Gears Up: Reliance Industries, led by Mukesh Ambani, is ready to disrupt the scene with JioMart’s quick commerce launch. They’re targeting grocery delivery in under 30 minutes for select cities, with plans to ramp up operations significantly next year.

- JioMart’s National Ambitions: The rumors suggest Reliance has massive plans – aiming for JioMart to reach a staggering 1,000 cities! This expansion will leverage Reliance Retail’s existing network of over 18,000 stores across the country. JioMart’s potential scale could shake up the market entirely.

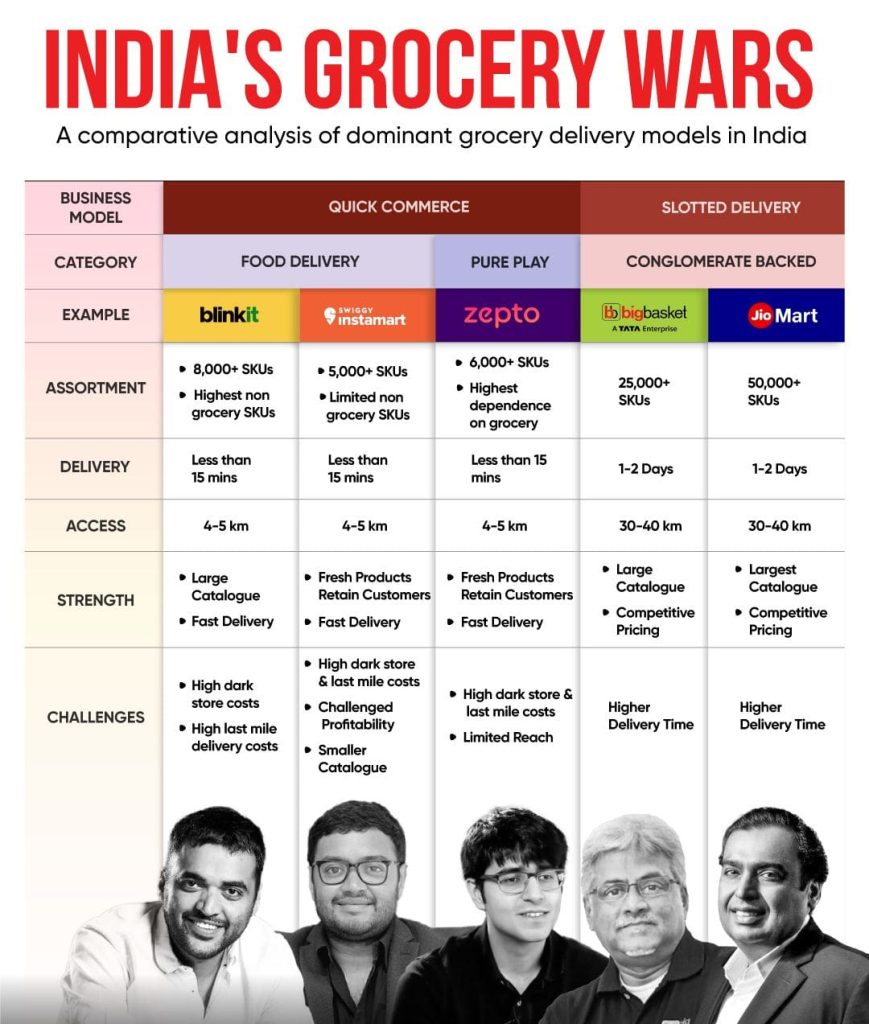

- Can Existing Players Compete? JioMart’s national reach could potentially overshadow current quick commerce leaders like Blinkit, Swiggy’s Instamart, and Zepto. It might even nip the grocery delivery aspirations of Tata-owned BigBasket and Flipkart before they take root.

- Flipkart’s Fresh Start: Backed by fresh investments from Google and Walmart (its majority shareholder), Flipkart is poised for a major grocery delivery push. Blinkit, Zepto, and Swiggy have already established strong models in this space, and Flipkart will need to strategize carefully to compete.

So, what does this mean for the future of quick commerce in India? We’re witnessing a battle of the titans, with established players like Zomato and Swiggy facing a well-funded challenger in JioMart. Flipkart’s entry adds another layer of intrigue. This intense competition will undoubtedly benefit Indian consumers, with faster deliveries, wider selection, and potentially even lower prices.

Let’s keep an eye on how this space unfolds! Who will dominate the quick commerce market in India? Share your thoughts in the comments below!